To trend or not to trend, that is the question -

I was mulling over the recent strength of the rally and where we could be going over the next 6-12 months this morning and I landed on earnings.

The downturn in 2022 and the rebound this year has been all about the "multiple" moving down then back up, "multiple" defined here as the ratio of price / earnings.

Since earnings haven't really come down, the last year and a half have been characterized by movements in the "catch all" metric of Price. It's a "catch all" because it ultimate reflects everything from perspectives on interest rate movements to fairy tales associated with non-profitable tech.

With consumer excess savings being spent down at a rapid clip and the Fed appearing to near an end to interest rate hikes, bulls will need to lean on earnings to keep the rally going. (Probably)

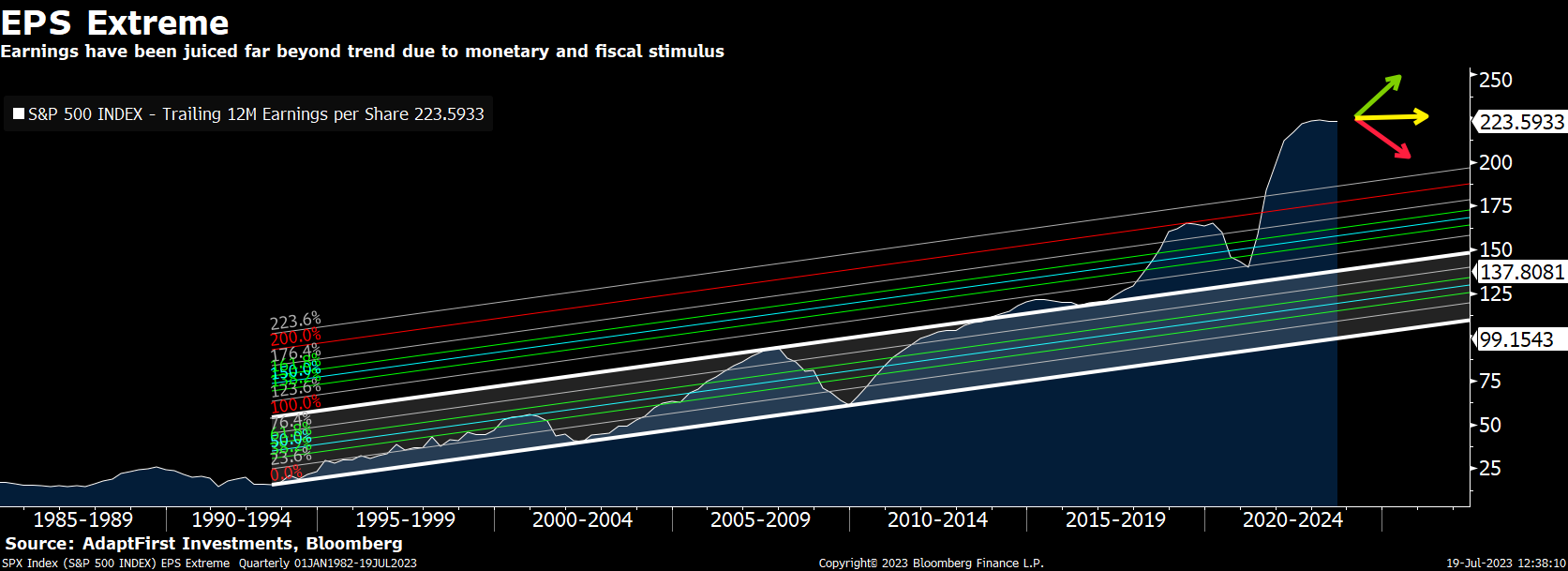

If you look back, in the beginning of the 1990s, earnings started to trend higher in a meaningful way. I would attribute that to the changes in technology during that time. Our society had a dramatic transformational leap as personal computers, cell phones, and more changed our lives forever. It would be similar to the way electricity, cars, and airplanes changed our world a century ago.

What’s interesting is that the Fed’s aggressive monetary response pushed earnings above that trend in 2018-2019. Add to that the fiscal stimulus and even more aggressive monetary response from the pandemic, along with the consumer response, and earnings catapulted into a new stratosphere. But this increase was driven by artificial means rather than technology and productivity advances. Is that sustainable and where do earnings go from here?

I feel a recession has been DELAYED due to “excess household savings” created from the pandemic stimulus, and we are likely to get some mean reversion as that is ultimately spent down.